Most Selling Electric Car Brands YouTube

For example, if you buy a brand new fully electric car for £35,000, and your business company tax rate is 19%, then the company tax for the accounting year will be reduced by 35,000 x 0.19 = £6,650. The company will also be able to get corporation tax relief on the costs of maintaining and insuring the vehicle.

Lease an electric car through my limited company No Worries Accounting

Leasing an electric car through a limited company. This article is based on the rules in place at the date of publication which was September 2021. We are being increasingly asked by business owners whether it's tax efficient for them to get an electric car through their own limited company, so we have written an article to explain the key.

You’ve Bought Your Company Electric Car Now What? Hive Business

A company purchases a fully electric car for £50,000 including VAT. A basic rate taxpayer director will use this as a company car, including personal trips. Corporation tax savings of £12,500 (£50,000 @ 25%) VAT reclaim of £4,167. Benefit in Kind of £1,000 (£50,000 @ 2%) taxed as below.

Electric Car Brand Logos

Capital allowances. Currently, businesses can claim 100% tax relief in the first year if the electric car is bought outright or via hire purchase, making this highly advantageous. If you buy an electric car after April 2021, the following applies: New and unused, CO2 emissions are 0g/km (or car is electric) = 100% first year allowances. This.

JPT What’s Driving Oil Companies to Buy Electric Car Charging Firms?

The plug-in car grant (PICG) is available to those buying eligible electric cars, vans, and motorcycles. It offers £2,500 towards the cost of qualifying plug-in cars that cost no more than £35,000. To qualify- the vehicle must have an electric range of at least 70 miles. If you are buying an eligible electric vehicle through your company, you.

Electric Company Car Discover the Tax Benefits in 2023/24

Phone us or request a callback 01296 468 483. Electric car lease explained for contractors. They often ask if their Limited company can provide a car for them, and the answer is yes, but there are costs involved. There has been some interest in electric cars recently.

Should you buy an electric car through your business? ChadSan

The grant offers a discount of up to £3,000 on the price of an electric car and £350 on the cost of installing a charger. By choosing an electric car, your company can claim a 100% first-year allowance on the cost of the vehicle provided it is purchased new. This is an enhanced rate of capital allowances which would reduce your company's.

Electric car lease through limited company JF Financial

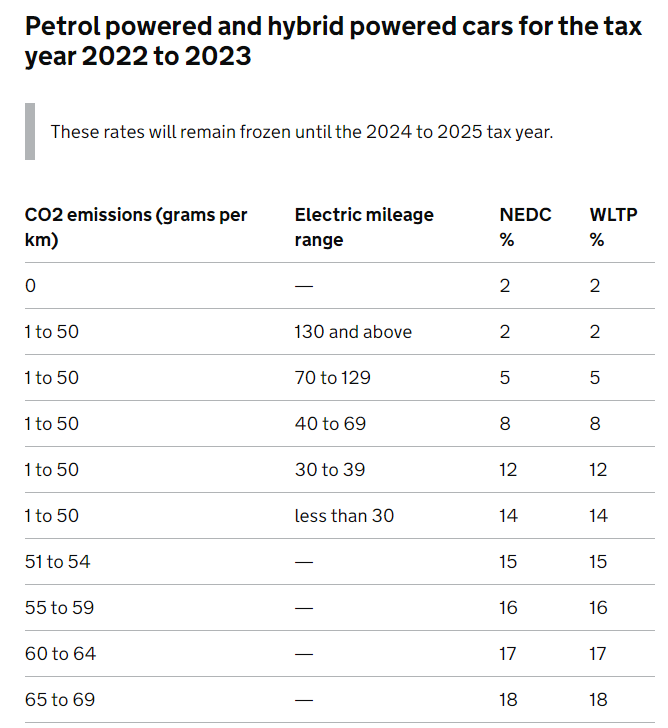

Benefit in kind on electric cars. The percentage of list price of a company car which is taxed as a benefit is determined by the CO2 emissions of the vehicle. For 2023/24, electric cars (with zero emissions - 0g/km) are taxed at just 2% of the list price. This rate will remain for tax year 2024/25 also.

Buying an electric car through my limited company No Worries Accounting

Buying an electric car through your own limited company is becoming the increasingly more popular choice over buying a standard petrol or diesel car. In fact, the Society of Motor Manufacturers and Traders have reported that the majority of electric car sales are made by businesses more so than private individuals. This is largely attributed to.

Best Electric Vehicle Charging Station Companies WebSta.ME

Some benefits of owning an electric vehicle include decreased overall taxable profits and a £500 discount on an EV charger. If you purchase an electric vehicle (EV) through your limited company, you are exempt from paying Benefit-in-Kind tax. Investing in an electric vehicle (EV) has many benefits, especially for businesses.

Can You Buy an Electric Car Through Your Company? Your Finance Team

Save 30-60% on any electric car through salary sacrifice.. ICO number ZB030706, VAT number 439430195), The Electric Car Scheme Holdings Limited (company number 13295877, ICO number ZB252629) and ECS M/G Ltd (company number 13292245). Registered address: The Shipping Building, 254 Blyth Road, UB3 1HA..

Things to Consider when Buying a Car Through Limited Company

In this article we outline the key tax reliefs available to Limited Companies who are considering purchasing an Electric Vehicle (EV). New company car tax rates came into effect from April 2020 and resulted in the rate of company car tax available on fully Electric Vehicles reducing from 16% to 0%. This increased to 1% in the 2020-2021 tax year.

You Can Own Part Of The Company That Makes This Awesome, SuperFast Electric Car The future of

It's important first of all to look at what is available through grants and tax incentives when choosing to buy an electric car through your business: The Government is offering plug-in car grants up to £1,500 if you purchase a vehicle that costs under £32,000. There are also grants and incentives available for businesses that install.

The Electric Car Scheme New EV, Tax Benefit! Really??

14%. A fully electric car with zero emissions and a retail price of £30,000 would therefore have no BiK for 20/21, £300 for 21/22 and £600 for 22/23. These figures would then be taxed on you at your highest rate of tax. So, if you are within the basic rate band your tax payable for 21/22 would be £60 (£300 x 20%).

Benefits of Electric Vehicles for Business Blue Rocket

Nomad Electric | 4,313 followers on LinkedIn. We are EPC, O&M and SCADA services provider for large-scale PV. | We are EPC, O&M and SCADA services provider for utility-scale solar & wind projects.

Property Investment Through Limited Company Blue Crystal

Advantages of buying an electric car through a limited company. Tax Benefits: Purchasing an electric car through a limited company in the UK can bring significant tax advantages. One of the primary benefits is the ability to claim 100% First Year Allowance (FYA) against taxable profits in the year of purchase if the car has CO2 emissions of 50g/km or less.